Odoo ERPAccountingFinance

What Is Odoo Accounting?

Odoo Accounting is a part of the larger Odoo suite, a robust business management software designed to streamline various aspects of your operations.

[Source - Accounting & Invoicing Data Migration]

At its core, Odoo Accounting focuses on providing businesses with a comprehensive financial management solution, that then seamlessly integrates with other Odoo modules like CRM, Inventory, and Sales for a holistic approach to business management.

Why Odoo Accounting Matters

In an age where data-driven decisions and financial transparency are paramount, Odoo Accounting offers an extensive range of features and functionalities that cater to businesses of all sizes.

Whether you're a new start-up looking for a cost-effective accounting solution or an established enterprise in need of advanced financial tools, Odoo Accounting has you covered.

Throughout this in-depth review, we'll delve into every aspect of Odoo Accounting, from the initial setup to its user interface, core features, pricing, and user experiences.

By the end of this guide, you'll have a comprehensive understanding of how Odoo Accounting can benefit your organisation and whether it's the right fit for your financial management needs.

So, without further ado, let's embark on our journey through Odoo Accounting and further explore how it can revolutionise your financial operations.

Setting Up Odoo Accounting

Getting started with Odoo Accounting is a straightforward process that begins with proper setup. In this section, we will walk you through the steps to set up Odoo Accounting for your business.

System Requirements

Before you dive into the setup process, it's essential to ensure that your system meets the necessary requirements to run Odoo Accounting smoothly. Here are the key system requirements to consider:

Hardware Requirements

- Server: You can either host Odoo on your own server or opt for cloud-based hosting. The hardware requirements may vary based on your choice.

- Storage: Ensure you have sufficient storage space to accommodate your accounting data.

- Processor and RAM: Odoo can run on a variety of hardware setups, but a multi-core processor and ample RAM are recommended for optimal performance.

Software Requirements

- Operating System: Odoo is compatible with various operating systems, including Linux, Windows, and macOS.

- Web Browser: A modern web browser (such as Google Chrome, Mozilla Firefox, or Microsoft Edge) is needed for accessing the Odoo web interface.

Installation Options

Odoo SaaS (Software as a Service)

- Odoo provides a Software as a Service (SaaS) option, where you can access Odoo via the cloud. This eliminates the need for on-premises server management.

- SaaS is ideal for businesses looking for a hassle-free solution, as Odoo manages server maintenance, updates, and security.

On-Premises Installation

- If you prefer more control over your system, you can choose to install Odoo on your own server.

- Odoo offers detailed installation guides and packages for Linux-based systems, making it accessible to a wide range of users.

- On-premises installation allows for customisation and integration with other software, providing flexibility to adapt to your specific needs.

Docker Installation

- For advanced users or those seeking isolation, Docker containers are available for Odoo.

- Docker simplifies deployment and scaling while maintaining system stability.

When setting up Odoo Accounting, it's vital to choose the right installation method that aligns with your preferences and business requirements.

Getting Started

Once you've selected your installation method, follow the respective setup instructions provided by Odoo. The setup typically involves

- Downloading and installing the Odoo software.

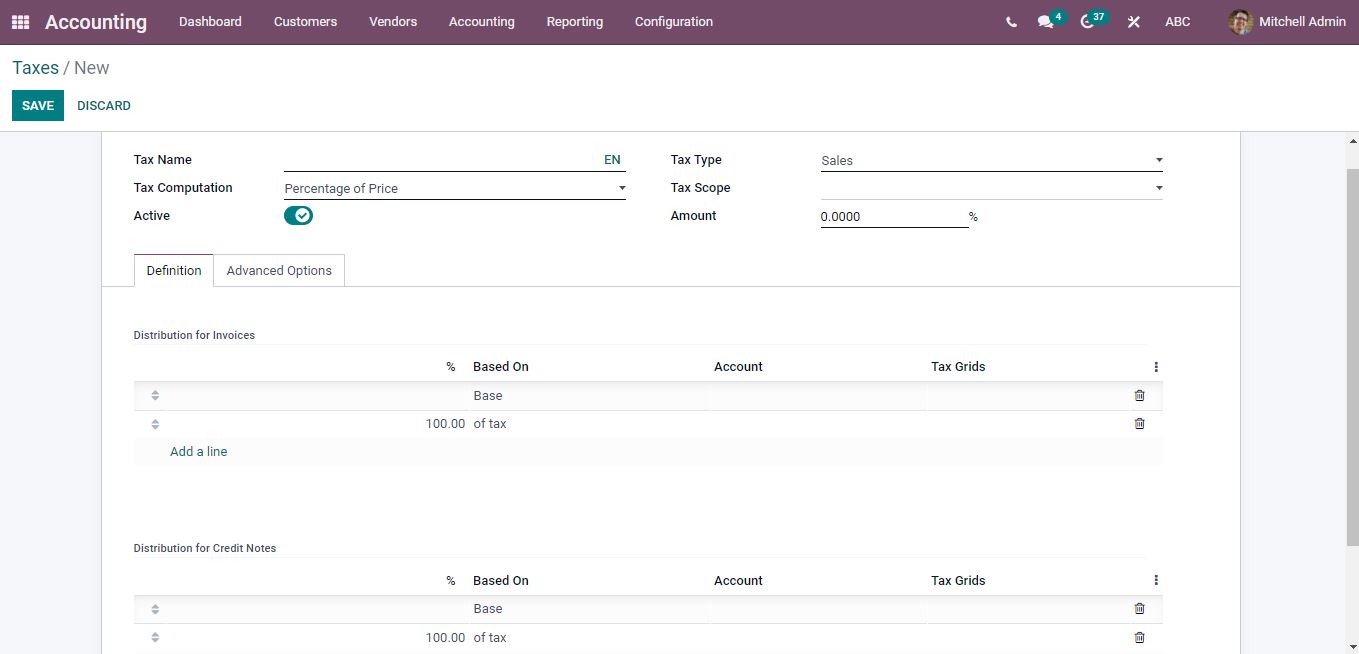

- Configuring basic settings such as your company details and currency.

- Setting up user accounts and permissions.

- Importing or inputting your existing financial data, if applicable.

Remember, Odoo provides extensive documentation and support to assist you throughout the setup process.

In the next sections of this review, we'll explore the user interface and navigation within Odoo Accounting, so you can become familiar with the software's interface and start managing your finances effectively.

User Interface and Navigation

Odoo Accounting further offers an intuitive and user-friendly interface designed to simplify financial management for businesses.

[Source - Accounting & Invoicing Data Migration]

In this section, we will explore the key elements of the user interface and guide you through the navigation process.

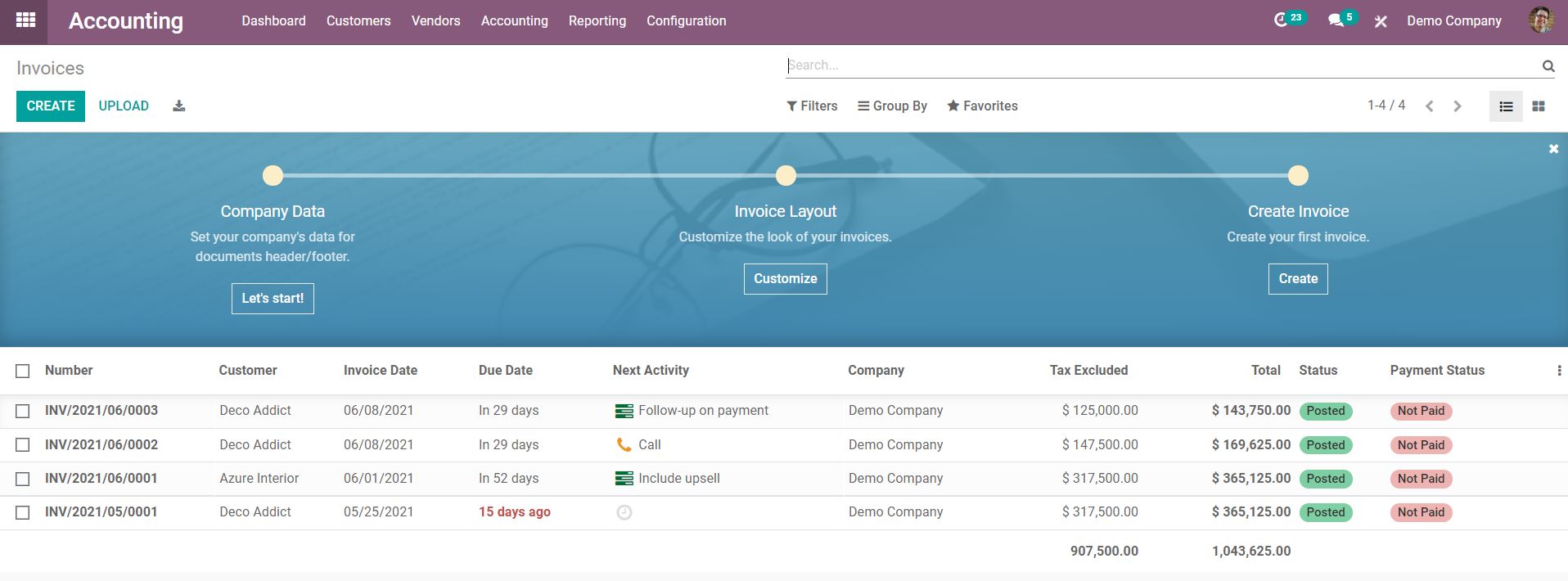

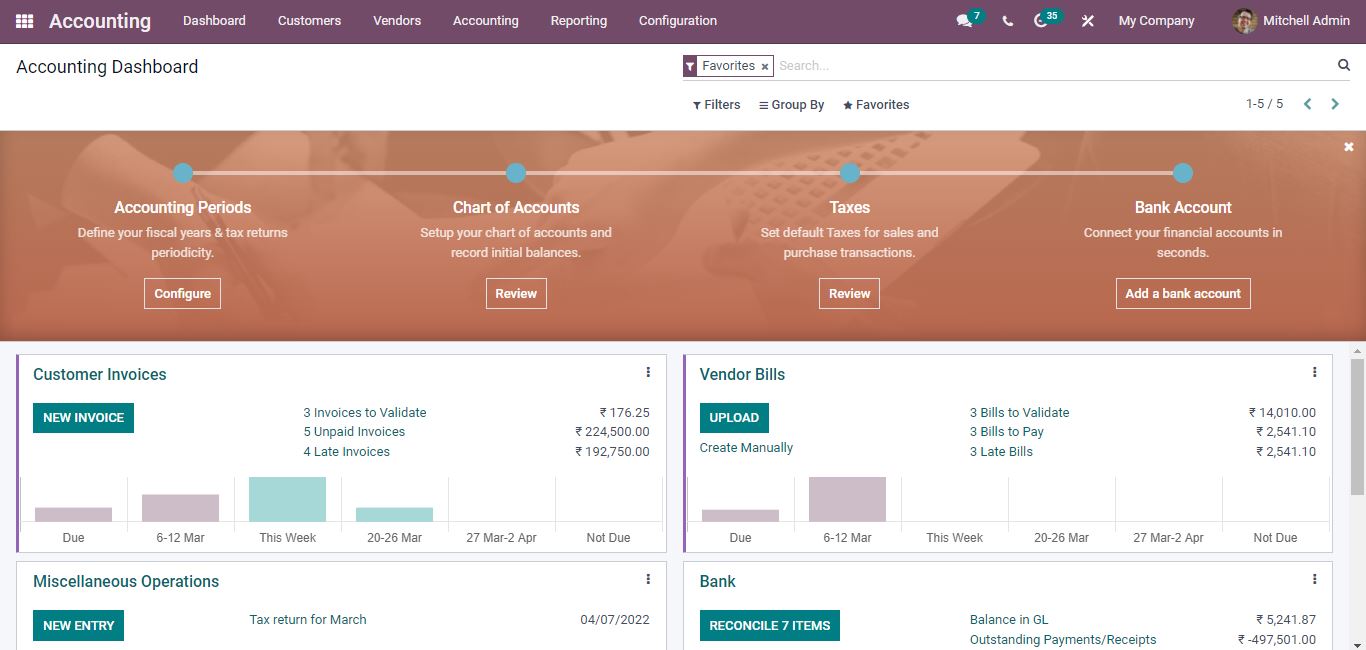

The Dashboard

Upon logging into Odoo Accounting, users are greeted with a clean and organised dashboard. Here's what you can expect:

- Overview: The dashboard provides an overview of your financial data, displaying essential information like account balances, recent transactions, and upcoming tasks.

- Quick Actions: Users can access frequently used features directly from the dashboard, such as creating invoices, recording expenses, or generating financial reports.

Main Menu

The main menu, typically located on the left-hand side of the screen, is the central hub for navigating all of Odoo Accounting. It is structured logically to ensure easy access to all the software's functionalities:

- Modules: Odoo Accounting seamlessly integrates with other Odoo modules. You can access these modules, such as Sales, Inventory, and CRM, from the main menu, allowing for a holistic view of your business operations.

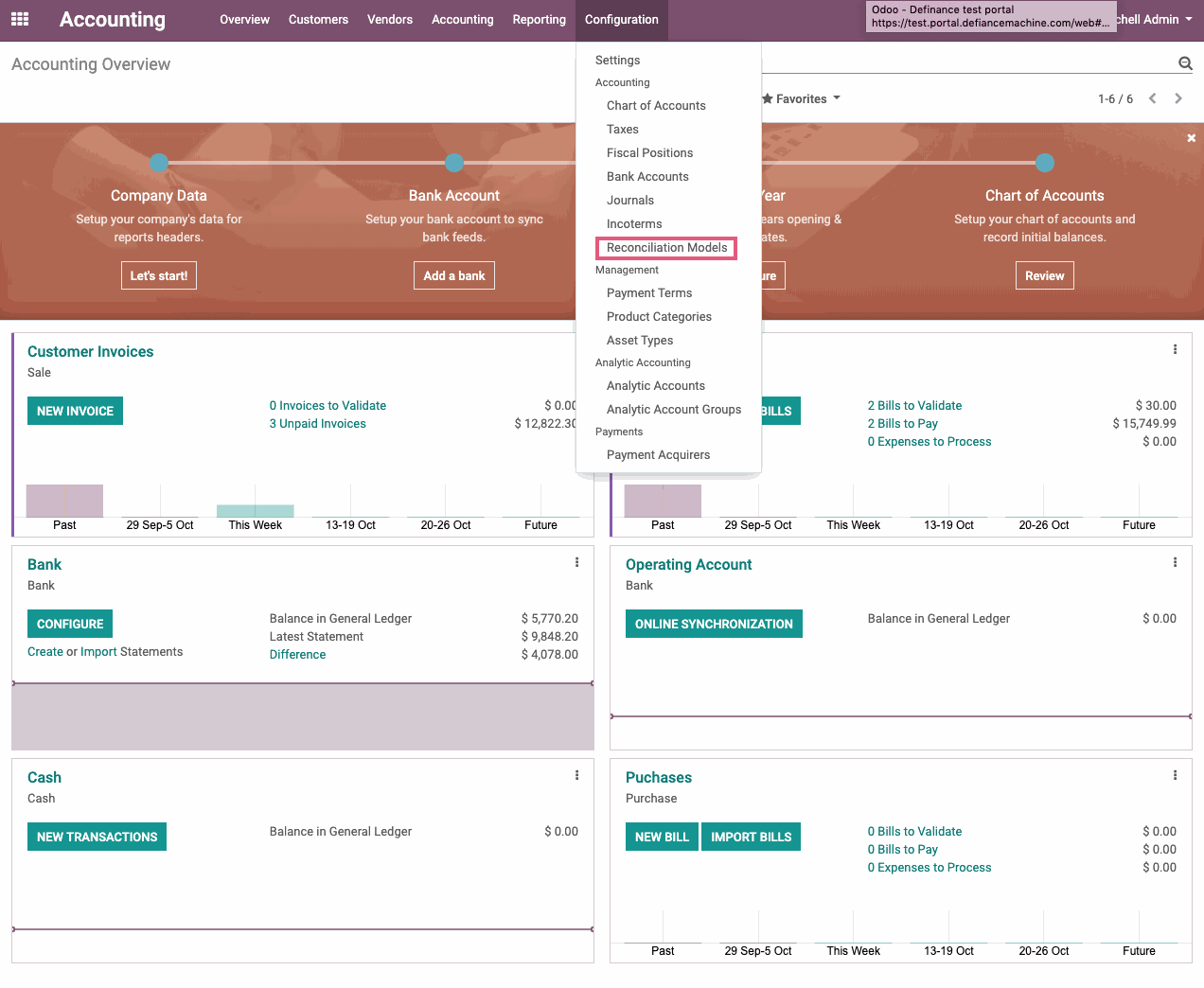

Navigation

Navigating within Odoo Accounting is straightforward, even for those new to accounting software:

1. Creating and Managing Financial Documents

- Invoices: You can easily create and manage invoices for your customers and suppliers. Odoo Accounting simplifies the process of generating invoices, tracking payments, and sending reminders.

- Expenses: Recording expenses is a breeze with Odoo Accounting. Users can upload receipts, categorise expenses, and track reimbursements efficiently.

2. Bank and Cash Management

- Bank Reconciliation: Odoo Accounting streamlines bank reconciliation by matching bank transactions with corresponding entries in your accounts, ensuring accuracy and consistency.

- Cash Flow Management: Gain insights into your cash flow with visual representations and reports. Monitor cash movements and plan accordingly.

3. Financial Reports and Analysis

- Reports: Odoo Accounting offers a wide range of customisable reports, including profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into your financial performance.

- Analytics: Dive deeper into your financial data with interactive analytics tools. Identify trends, make informed decisions, and strategise for growth.

User-Friendly Features

Odoo Accounting is known for its user-friendly features and design elements:

- Drag-and-Drop Functionality: Easily upload files, attach documents to transactions, and organise data using a simple drag-and-drop interface.

- Customisable Dashboards: Tailor you're dashboard to display the information that matters most to your business, ensuring you have quick access to essential data.

- Mobile Accessibility: Access Odoo Accounting on the go with mobile apps, enabling you to manage finances from anywhere, anytime.

- Multi-Currency Support: If your business operates internationally, Odoo Accounting offers robust multi-currency support, simplifying cross-border transactions and financial reporting.

Odoo Accounting's user interface and navigation have been designed with user-friendliness and efficiency in mind.

Whether you're an experienced accountant or even a business owner handling finances, the software's intuitive design and super powerful features make it accessible and effective.

[Source - Infintor Solutions]

In the upcoming sections of this review, we will delve deeper into the core accounting features, automation capabilities, key reporting tools, pricing plans, user experiences, and more, to provide a comprehensive understanding of how Odoo Accounting can benefit your business.

Core Odoo Accounting Features

Odoo Accounting boasts a comprehensive suite of core accounting features that serve as the bedrock of effective financial management.

These features are fully designed to streamline financial operations, enhance accuracy, and even empower businesses to make data-driven decisions. Let's delve deeper into each of these features:

Odoo Accounting Features

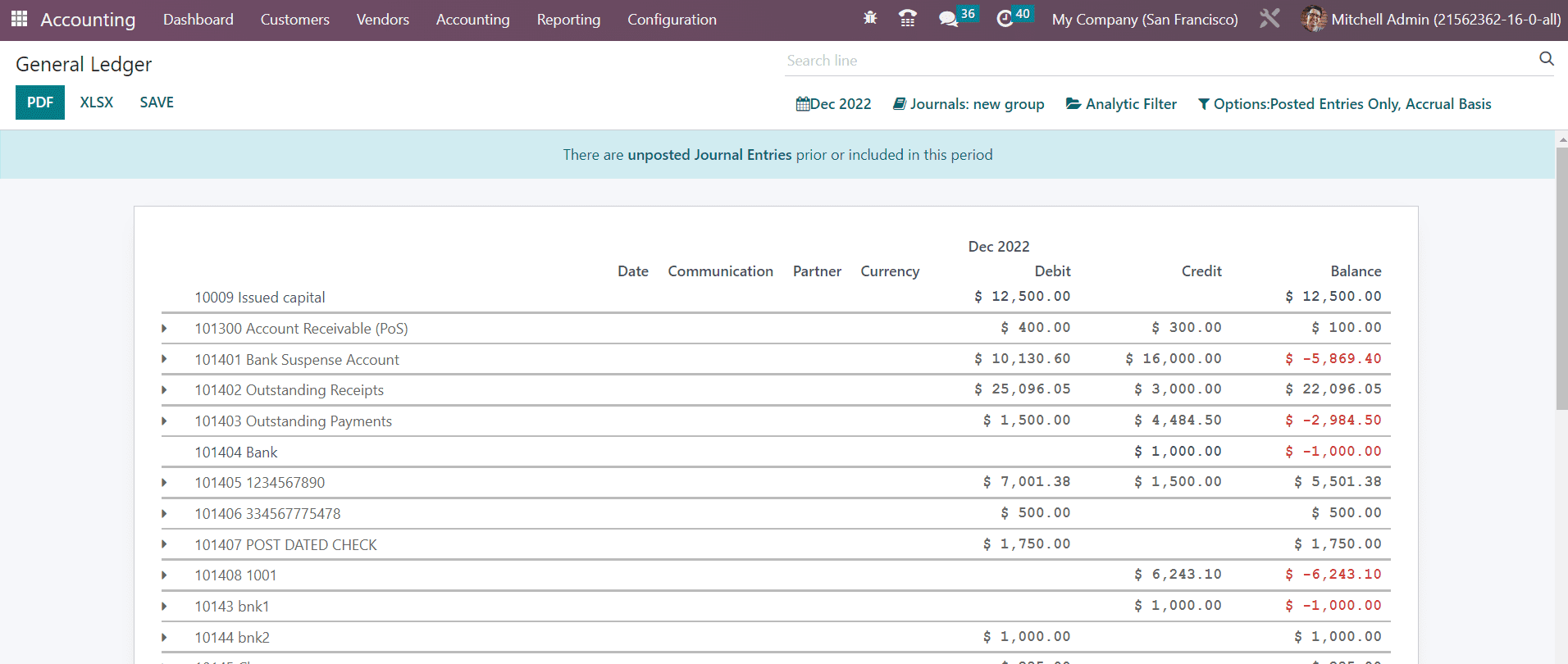

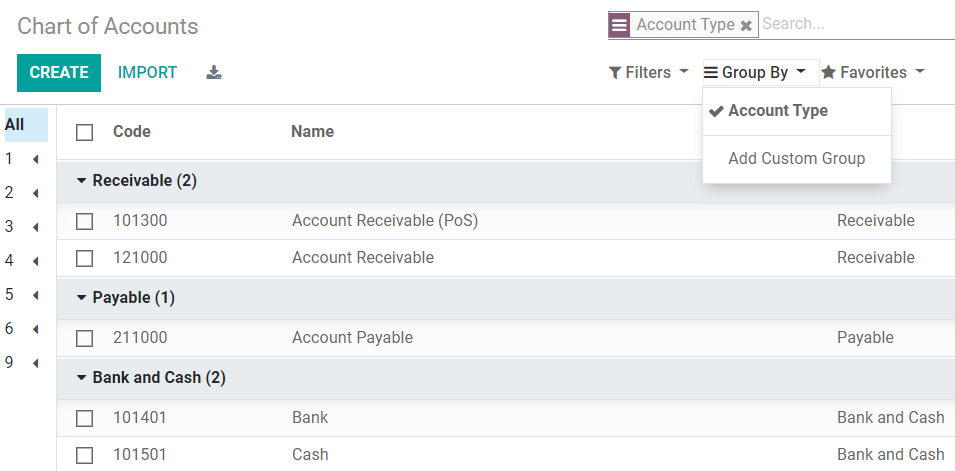

General Ledger

The General Ledger is the central repository of all financial transactions in Odoo Accounting. It serves as the foundation of all your financial records, ensuring every inflow and outflow of money is accurately documented. Let's delve into its key functions and benefits.

[Source - Cybrosys Technologies]

- Transaction Recording: Odoo Accounting simplifies the process of recording all financial transactions, ensuring every inflow and outflow of money is accurately documented.

- Chart of Accounts: Create and manage a detailed chart of accounts tailored to your business needs. This organisational structure helps you categorise transactions for reporting and analysis.

- Real-Time Updates: Enjoy real-time updates to your general ledger, offering an instant view of your financial health as transactions occur.

- Double-Entry Accounting: Odoo Accounting employs the double-entry accounting method, where every transaction is recorded with a corresponding entry, maintaining balance and accuracy in your financial records.

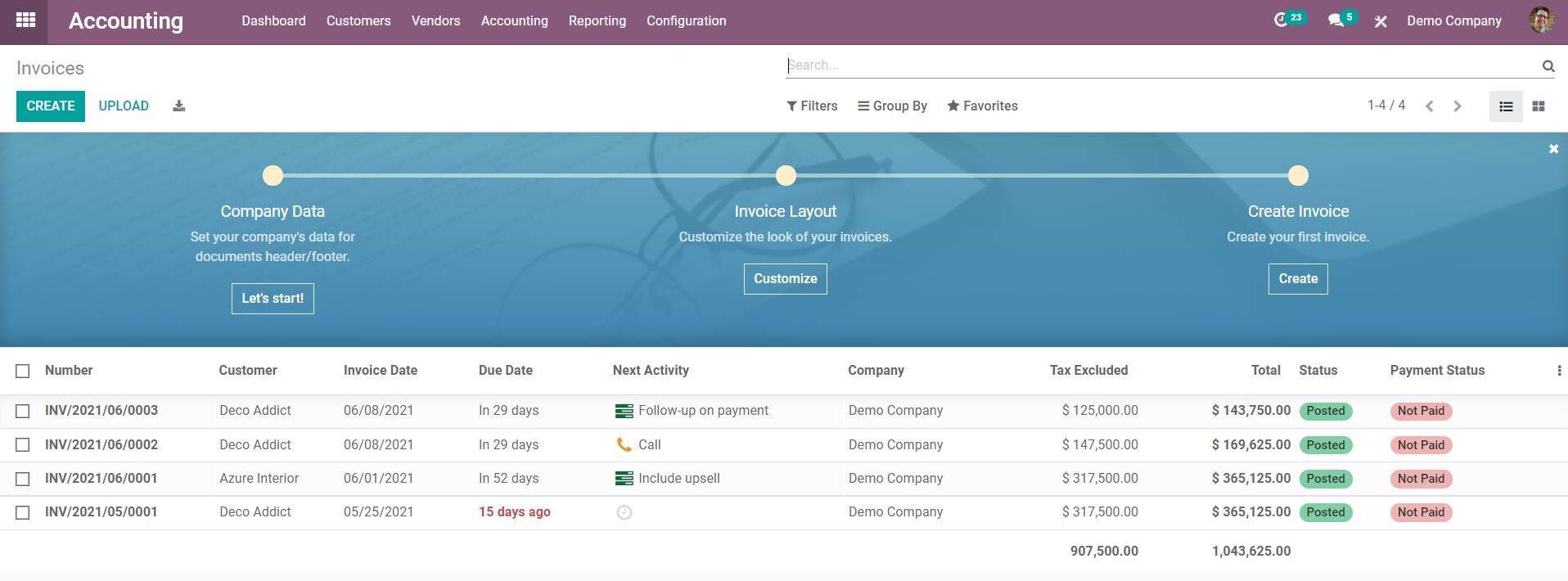

Accounts Payable and Receivable

Managing accounts payable and receivable efficiently is crucial for maintaining a steady healthy cash flow. Odoo Accounting simplifies this process, from invoicing to follow-ups and expense tracking.

- Invoicing: Generate invoices effortlessly and send them to your clients. Odoo Accounting allows for customisation of invoices, including adding your branding and specifying payment terms.

- Automatic Follow-Ups: Automate the process of sending follow-up reminders for unpaid invoices. This not only improves cash flow but also reduces the administrative burden of chasing payments manually.

- Supplier Bills: Effectively manage supplier bills, track expenses, and schedule payments to ensure timely settlements and build strong supplier relationships.

- Customer Payments: Seamlessly receive payments from your customers and apply them directly to outstanding invoices, reducing manual data entry and potential errors.

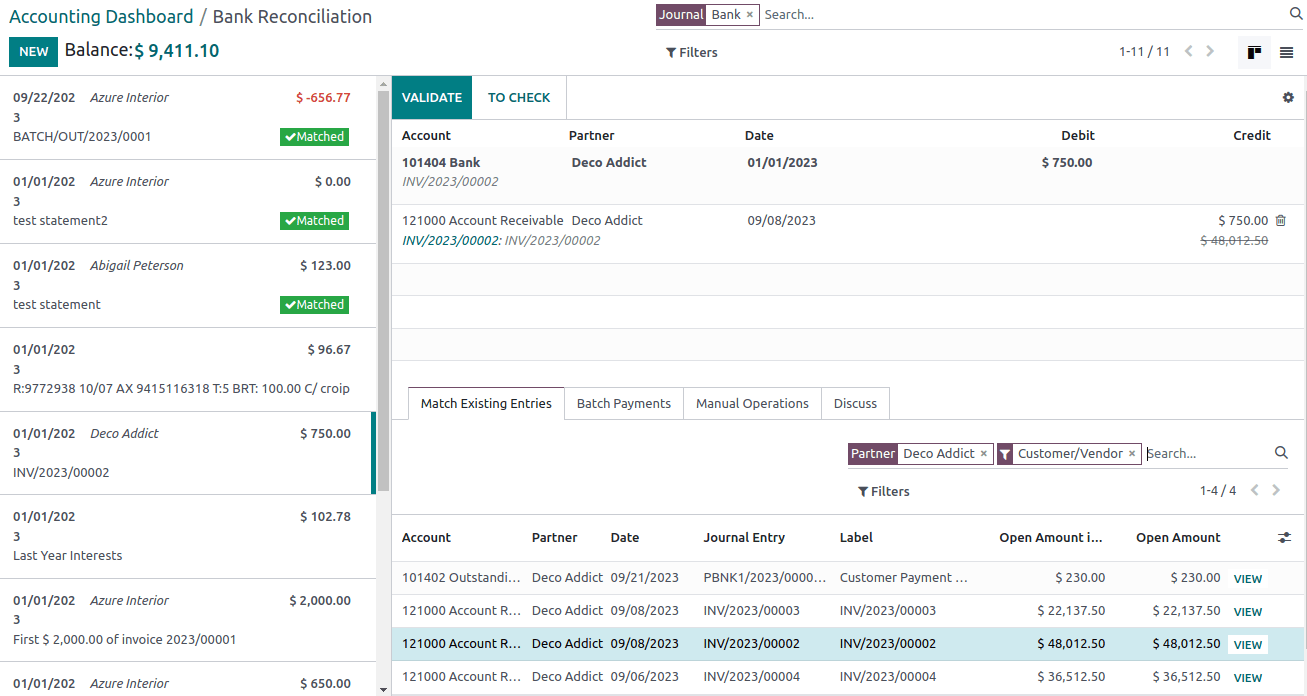

Bank Reconciliation

Bank reconciliation is crucial for ensuring that your financial records match your bank statements. Odoo Accounting simplifies this process with features designed to minimise errors and save time.

[Source - Odoo]

- Importing Bank Statements: Odoo Accounting simplifies the import of bank statements, reducing the need for manual data entry and minimising errors.

- Transaction Matching: The software automates the matching of transactions in your bank statements with entries in your general ledger, ensuring reconciliation is both fast and precise.

- Exception Handling: In cases where discrepancies or exceptions arise, Odoo Accounting provides tools to resolve these issues and reconcile accounts efficiently.

Streamlining Financial Operations

These core features further significantly enhance financial operations in several ways:

- Accuracy: The rigorous double-entry accounting system ensures that each financial transaction is accurately recorded, reducing the risk of errors and discrepancies.

- Efficiency: Automation features, such as invoice generation and bank reconciliation, save time and effort, allowing you to allocate resources more strategically.

- Real-Time Insights: With real-time updates to your general ledger and the ability to generate financial reports on demand, you gain access to up-to-the-minute financial insights for informed decision-making.

- Cash Flow Optimisation: The accounts payable and receivable features, coupled with automatic follow-ups, are instrumental in optimising cash flow by facilitating timely payments from customers and to suppliers.

- Financial Compliance: Odoo Accounting is designed with financial regulations and accounting standards in mind, ensuring that your business can meet its financial reporting requirements with ease.

The features are just the beginning of what Odoo Accounting has to offer. In the subsequent sections of this review, we will then explore additional facets such as automation capabilities, advanced reporting and analytics, pricing plans, user experiences, and much more, to provide a bigger comprehensive understanding of how powerful Odoo Accounting is.

Automation and Efficiency

Automation is a pivotal feature of Odoo Accounting, bringing ease and efficiency to your financial management.

It empowers businesses by automating essential processes, including invoice generation and expense tracking.

Let's take a closer look at how these automation capabilities work and why they are crucial for improving operational efficiency.

I have the feeling I lived in the middle ages for the past 10 years… and that’s only one of the many feedbacks we receive from accounting firms that switched to Odoo after having worked on traditional accounting tools for many years!

Wynand Tastenhoye - Accounting Firms Bij Odoo

Invoice Generation

Generating invoices is a routine but vital part of running any business. Odoo Accounting streamlines this process in a way that not only saves time but also ensures consistency and professionalism.

[Source - Cybrosys Technologies]

Automation Simplifies Invoicing

With Odoo Accounting's automation:

- Effortless Generation: Invoices are generated automatically based on predefined templates and transaction data. This means less manual input and fewer chances for errors.

- Customisation: You can customise invoice templates to match your brand identity and include specific payment terms, ensuring clear and professional communication with your clients.

- Recurring Invoices: For businesses with subscription-based services or recurring charges, Odoo Accounting can automatically create and send invoices at scheduled intervals, reducing administrative overhead.

- Time Savings: The automation of invoice generation saves your team a significant amount of time, allowing them to focus on core business activities rather than getting bogged down in paperwork.

Expense Tracking

Tracking expenses accurately is critical for budgeting, financial control, and maintaining a clear financial picture of your entire business. Odoo Accounting simplifies expense tracking through automation, which translates into efficiency gains.

[Source - Odoo]

Streamlining Expense Management

Automation in expense tracking means:

- Receipt Upload: Users can easily upload receipts and related documents directly into the system through an intuitive interface, reducing the hassle of manual handling.

- Automatic Categorisation: Odoo Accounting can automatically categorise expenses based on predefined rules or user-defined categories, minimising the need for manual classification.

- Real-Time Updates: Expenses are recorded in real-time, updating your financial records instantly. This ensures that your financial reports remain accurate and up-to-date.

- Approval Workflows: Implementing approval workflows ensures that expenses are reviewed and authorised before payment, enhancing financial control and compliance.

The Efficiency Boost

The automation features in Odoo Accounting deliver needed tangible efficiency benefits:

- Reduced Manual Effort: Automation significantly reduces the need for extensive manual data entry, lowering the risk of errors and speeding up processes.

- Time Savings: With invoice generation and expense tracking automated, your team can allocate their time more efficiently, concentrating on strategic tasks.

- Enhanced Accuracy: Automated processes are less prone to human error, guaranteeing the accuracy and compliance of financial records.

- Improved Cash Flow: Automated invoicing and expense tracking can expedite payments from customers and streamline the approval and reimbursement of expenses, leading to better cash flow management.

- Real-Time Insights: Automation provides real-time updates, enabling businesses to access up-to-the-minute financial insights for informed decision-making.

- Scalability: As your business grows, automation can scale alongside it, handling increased transaction volumes without a proportional increase in manual effort.

Automation is not just about convenience; it's also a powerful tool for enhancing efficiency, reducing operational costs, and allowing you to focus on the strategic aspects of your business.

Reporting and Analytics

In the realm of financial management, data is king, and being able to effectively interpret and act on that data is paramount.

[Source - Infintor Solutions]

Odoo Accounting equips businesses with robust reporting tools and analytics features that empower them to gain valuable insights from their financial data.

Reporting Tools

Visualising Financial Information for Clarity

Financial reporting is the bedrock of understanding your company's financial health and performance.

With Odoo Accounting's reporting tools, you can then translate raw financial data into comprehensible reports that offer a clear snapshot of your financial situation.

These tools include:

- Financial Statements: Odoo Accounting enables you to generate essential financial statements such as profit and loss (P&L) statements, balance sheets, and cash flow statements.

These statements provide a comprehensive overview of your company's financial position. - Customisation: Tailor your reports to fit your specific needs. Customise them to focus on the metrics that matter most to your business, ensuring that the data presented is relevant and actionable.

- Automation: Schedule the automatic generation and delivery of reports to key stakeholders, ensuring they always have the latest financial information at their fingertips.

This automation minimises the effort required to keep everyone informed. - Comparative Analysis: Compare current financial data with data from previous periods to identify trends, patterns, and fluctuations.

This historical perspective is invaluable for making informed financial decisions.

Analytics

Turning Data into Actionable Insights

While reporting offers a big snapshot of your financial performance, analytics take things further by transforming raw data into actionable insights.

Odoo Accountings analytics features provide a deeper understanding of your financial data and its implications for your business.

Here's how analytics come into play:

- Interactive Dashboards: Access interactive dashboards that provide at-a-glance views of key performance indicators (KPIs).

These visual summaries allow you to monitor the financial health of your business in real time, making it easier to identify both strengths and areas that require attention. - Data Visualisation: Visualise financial data through charts, graphs, and other visual representations.

Data visualisation simplifies complex information, making it easier to grasp and analyse. - Drill-Down Capabilities: Dive deeper into the data by drilling down into specific transactions and accounts.

This granular analysis allows you to pinpoint the root causes of financial trends or anomalies. - Budget vs. Actual Analysis: Compare budgeted figures to actual results, providing insights into where your business is exceeding expectations or falling short.

This analysis is essential for adjusting strategies and ensuring financial goals are met.

Gaining Insights

Leveraging Financial Data for Informed Decisions

The reporting and analytics capabilities within Odoo Accounting offer businesses several distinct advantages:

- Informed Decision-Making: Access to clear and timely financial information enables businesses to make informed decisions. Whether it's adjusting budgets, reallocating resources, or identifying opportunities for growth, having reliable data at your disposal is crucial.

- Performance Tracking: Regularly monitoring financial reports and analytics allows you to track your business's performance against key benchmarks and objectives. It's a vital tool for staying on course toward your financial goals.

- Early Warning Systems: Visual cues in dashboards and reports can alert you to financial issues or irregularities early on, enabling proactive intervention and minimising potential damage.

- Operational Optimisation: Analysing expense data helps identify areas of inefficiency or excess spending. Armed with this information, you can optimise operational costs, improving your bottom line.

- Financial Strategy: By mining insights from historical data, industry trends, and current market conditions, businesses can develop and refine their financial strategies, ensuring they remain competitive and adaptable.

- Compliance: Odoo Accounting's reporting tools help ensure compliance with financial regulations and standards. Having accurate, audit-ready financial reports readily available streamlines the compliance process and minimises risks.

In conclusion, Odoo Accounting's reporting and key analytics tools empower businesses to transform their financial data into actionable insights. This capability is not only beneficial for financial management but also for strategic planning and decision-making.

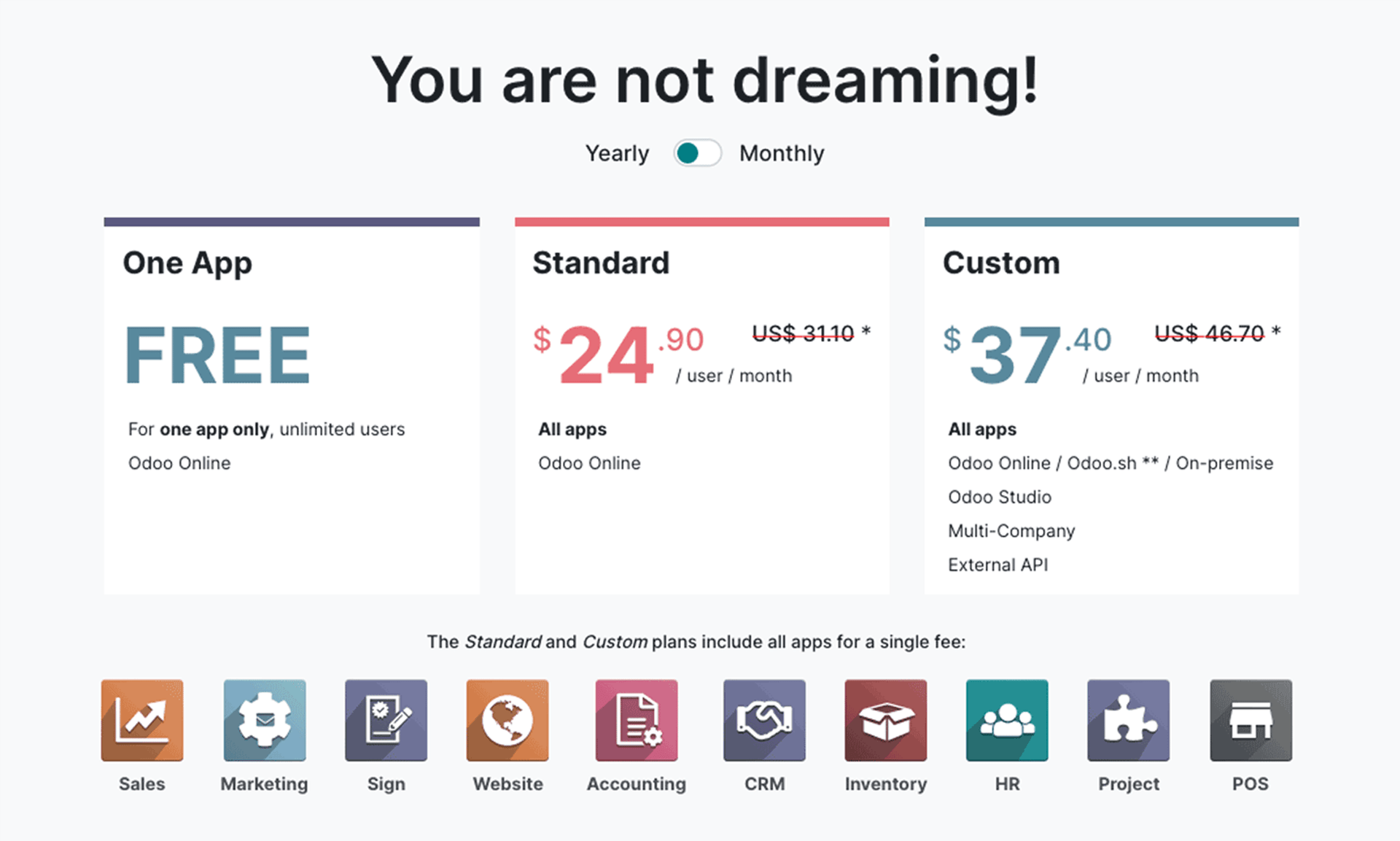

Odoo Accounting Plans

When considering adopting Odoo Accounting, it's absolutely crucial to understand the available pricing plans and what each plan offers in terms of features and benefits.

[Source - Odoo]

Odoo Accounting provides multiple subscription options to cater to the diverse needs of businesses. Below, we will outline the key pricing plans and their respective features.

When considering the pricing plans for Odoo Accounting, it's essential to be aware of the key features and benefits that are associated with each plan.

Odoo Accounting - Free Plan

The Free Plan by Odoo Accounting is an entry-level offering designed to meet the basic accounting needs of small businesses and start-ups. It provides a cost-effective way to get started with the Odoo accounting software without incurring any subscription fees.

Key Features:

- General Ledger: Access to the fundamental double-entry accounting system.

- Invoicing: Create and send invoices to customers.

- Expense Tracking: Manage expenses efficiently.

- Bank Reconciliation: Match bank transactions with your accounting records.

- Basic Reporting: Generate essential financial statements.

- Limited Users: Typically designed for a single user or small teams.

Benefits:

- Cost-Effective: Ideal for businesses with tight budgets.

- Fundamental Accounting: Provides core accounting functionality.

- Suitable for Small Businesses: A good starting point for small businesses with basic accounting needs.

Odoo Accounting - Standard Plan

The Standard Plan is a more comprehensive offering further designed for businesses that require advanced accounting features and have the capacity to grow. It's suitable for small to mid-sized businesses.

Key Features:

- Everything in the Free Plan: All features included in the Free Plan.

- Multi-User Support: Access for multiple users, making collaboration more manageable.

- Advanced Reporting: Access to more detailed financial reports and analytics.

- Automated Follow-Ups: Automate follow-up reminders for unpaid invoices.

- Advanced Expense Management: Additional features for handling expenses and reimbursement.

- Supplier Bills: Manage supplier bills more comprehensively.

- Integration: Easily integrate with other Odoo modules, such as Inventory and Sales.

Benefits:

- Advanced Functionality: Offers more features for comprehensive financial management.

- Collaborative: Supports multiple users, facilitating teamwork and delegation.

- Scalable: Suitable for growing businesses that anticipate increased accounting needs.

Odoo Accounting - Enterprise Plan

The Enterprise Plan is a high-tier offering designed for much larger enterprises with larger complex accounting requirements. It's ideal for organisations that need advanced features and customisation options.

Key Features:

- Everything in the Standard Plan: All features included in the Standard Plan.

- Customisation: Extensive customisation options for tailoring the software to specific business needs.

- Multi-Company Support: Manage finances for multiple companies from a single interface.

- Advanced Security: Enhanced security features and user access controls.

- Dedicated Support: Priority support from Odoo's experts for any issues or questions.

Benefits:

- Enterprise-Ready: Designed for organisations with advanced accounting needs.

- Highly Customisable: Allows businesses to adapt the software to their unique processes.

- Multi-Company Management: Ideal for conglomerates or businesses with subsidiary companies.

- Priority Support: Access to premium support to address concerns swiftly.

Selecting the appropriate Odoo Accounting plan depends on your business's size, complexity, and financial management needs.

The Free Plan provides an excellent starting point for small businesses, while the Standard Plan offers more advanced features and supports multiple users.

Larger enterprises with intricate accounting requirements may find the Enterprise Plan best suited to their needs. It's essential to consider your business's current state and future growth when making this decision.

Purchase Odoo Accounting

The Importance of Trying Before Buying With Software

Before committing to any software, it's crucial for businesses to have a first-hand experience of the platform's capabilities.

Odoo Accounting recognises this and offers two valuable options to help users explore the software before making a purchase decision: a free trial and a demo.

FREE Trial of Odoo

Odoo Accounting provides a free trial period, which allows potential users to get a hands-on experience of the software's features and functionality. Here's how to access the free trial:

- Visit the Official Website: Head to the Odoo official website. You can usually find a prominent "Free Trial" or "Try for Free" button.

- Sign Up: To start the free trial, you'll typically need to sign up with your basic information, including your name, email address, and sometimes company details.

- Choose Your Plan: Select the plan you're interested in (e.g., Free Plan, Standard Plan, or Enterprise Plan).

- Access the Trial: Once signed up, you'll gain access to a trial version of Odoo with the selected plan's features. The trial duration may vary, but it's typically long enough to thoroughly evaluate the software.

During the free trial period, you can explore the software, enter sample data, and test its capabilities.

This first-hand experience is invaluable when understanding if Odoo Accounting aligns with your business's specific needs and workflows.

Odoo Accounting Tutorials

In addition to the free trial, Odoo provides video tutorials that give users a key guided tour of the software's features and functionalities. Here's how to access a demo:

- Visit the Official Website: Head to the Odoo Accounting official website.

- Find the Tutorial Section: In the top menu bar click the community dropdown and select "Tutorials" under "Learn".

- Launch the Tutorial: Click on "Accounting and Invoicing". You'll be presented with 4 hours and 23 minutes of videos.

The tutorials an excellent option for those who want a quick and structured introduction to Odoo Accounting. It provides an overview of the software's capabilities and can also be a useful starting point for understanding its potential benefits for your business.

Why Trying Before Buying Matters

Trying a software like Odoo Accounting before making a commitment is crucial for several reasons:

- Compatibility: You can assess whether the software aligns with your business's specific accounting needs and workflows.

- User-Friendliness: A trial or demo helps you evaluate the software's ease of use and how well your team can adapt to it.

- Feature Evaluation: You can test specific features and functionalities to determine if they meet your requirements.

- Cost-Effectiveness: By trying the software, you can make an informed decision about whether the paid plans offer sufficient value to justify the investment.

- Overall Fit: It's an opportunity to determine if Odoo Accounting is the right fit for your business's long-term financial management.

Odoo Accounting provides a free trial and tutorial section to ensure that potential users can then assess the software's suitability for their needs.

Trying before buying is a valuable step in making an informed decision about your accounting software, ensuring that it then aligns with your business's unique requirements and workflows.

Unlocking Your Success With The Odoo ERP Accounting Software

One of the most effective ways to understand the practical benefits of a software solution is to examine real-world case studies.

Here, we present two compelling stories of businesses which have harnessed the power of Odoo Accounting to streamline their financial operations and drive success.

Case Study #1: Streamlining Financial Management for a E-commerce Brand

Business: An up-and-coming new e-commerce brand specialising in fashion and accessories.

Challenge: The company experienced rapid growth, but with it came increasingly complex financial transactions, from supplier payments to order fulfilment and customer invoicing.

Their existing accounting system struggled to then keep up, leading to inefficiencies and the risk of financial errors.

Solution: The business then decided to implement Odoo Accounting's Standard Plan to gain access to all advanced accounting features and multi-user support.

This allowed them to collaborate effectively across teams and manage the growing volume of financial data.

Outcome:

- Efficiency Boost: With Odoo Accounting, the business automated tasks like invoice creation, expense tracking, and bank reconciliation, saving substantial time and reducing the risk of errors.

- Real-Time Visibility: The company gained real-time visibility into its financial data, enabling quick decision-making and improved cash flow management.

- Scalability: As the business continued to expand, the software seamlessly scaled to accommodate the increased transaction volume and complexity.

- Satisfied Customers: Improved efficiency in processing customer orders and timely invoicing led to increased customer satisfaction and repeat business.

Case Study #2: Enhancing The Financial Control for a Multi-National Corporation

Business: A multi-national corporation including multiple subsidiary companies within the business.

Challenge: Managing the finances of various subsidiary companies while ensuring compliance with international financial standards and regulations was a complex task.

The business needed a solution that offered multi-company support and robust security features.

Solution: The corporation opted for the Odoo Accounting Enterprise Plan, which provided advanced customisation options, multi-company support, and enhanced security features.

Outcome:

- Streamlined Multi-Company Management: With the ability to manage the finances of multiple subsidiary companies from a single interface, the corporation gained efficiency in financial control.

- Customisation for Unique Processes: The extensive customisation options allowed the business to adapt the software to its unique financial processes, ensuring compliance with international standards.

- Advanced Security: Enhanced security features and user access controls provided peace of mind regarding sensitive financial data.

- Priority Support: The availability of priority support ensured that any questions or issues were promptly addressed.

These case studies demonstrate the tangible benefits that businesses can achieve with Odoo Accounting.

Whether it's streamlining all your financial operations for a growing e-commerce brand or enhancing financial control for a multi-national corporation, Odoo Accounting offers solutions that lead to efficiency, improved financial management, and overall success.

The Pros of Odoo Accounting

Odoo Accounting offers a range of advantages and benefits that make it a compelling choice for businesses of all sizes. Here are the critical strengths of Odoo Accounting:

[Source - Odoo]

1. Comprehensive Accounting Features

With its robust double-entry accounting system, Odoo Accounting ensures the accuracy and reliability of financial data.

This comprehensive set of features further covers the entire financial spectrum, making it suitable for businesses with various accounting needs across the business.

2. User-Friendly Interface

The software's user-friendly design ensures that even those without extensive accounting backgrounds can navigate it with ease.

It streamlines the financial management process, then reducing the learning curve for users.

3. Automation and Efficiency

Automation further reduces manual data entry and repetitive tasks, enhancing efficiency and reducing the risk of errors.

The software automates invoice creation, simplifies expense tracking, and ensures bank transactions match accounting records.

4. Reporting and Analytics

The reporting and analytics capabilities provide visual summaries of key performance indicators, facilitating data visualisation, allow drill-down analysis, and support budget vs. actual comparisons.

This empowers businesses to make informed decisions and track their financial performance effectively.

5. Scalability

As businesses expand, Odoo Accounting can also seamlessly scale to accommodate the increased transaction volumes and more complex financial operations.

This scalability ensures that the software remains a valuable asset as a company grows.

6. Pricing Flexibility

The availability of multiple pricing plans allows businesses to choose one that aligns with their financial capabilities and requirements.

The free plan provides an entry point for start-ups & small businesses, while paid plans offer advanced features for more extensive financial management.

7. Customisation Options

Businesses can also adapt the software to their specific accounting workflows, ensuring that it aligns with their financial processes and regulatory compliance.

This customisation flexibility enhances the software's versatility.

8. Multi-Company Support

For multi-national corporations with multiple subsidiaries, this feature simplifies financial control, data consolidation, and reporting across different entities.

9. Priority Support (Enterprise Plan)

Priority support ensures that any concerns or questions are addressed promptly, reducing downtime and ensuring a smooth experience with the software.

Odoo Accounting offers a compelling set of advantages, ranging from its vast features to user-friendliness, automation, and scalability.

The software is designed to meet the accounting needs of businesses at various stages of growth and complexity, making it a valuable asset for efficient financial management.

Contact Us For A Free Consultation

Cons of Odoo Accounting

While Odoo Accounting offers a host of benefits, it's essential to be aware of potential drawbacks and limitations.

Here are some common challenges associated with Odoo Accounting, along with suggestions for overcoming them:

1. Learning Curve for Advanced Features

Challenge: Odoo Accounting's extensive feature set, while beneficial, can create a learning curve, particularly for all users who are new to accounting software.

Suggestions: To address this challenge, consider investing time in training and education for your team. Odoo often provides resources, including documentation and video tutorials, to help users become proficient with the software.

Additionally, starting with the Free Plan can allow users to familiarise themselves with the basics before transitioning to more advanced features.

2. Customisation Complexity

Challenge: While customisation is a strength of Odoo Accounting, extensive customisation options can be complex for users who need highly tailored workflows.

Suggestions: It's advisable to work with an experienced Odoo partner such as Gravitai when seeking advanced customisations. Our experts can also help configure the software to match your specific processes effectively.

Collaborating with Odoo's partners or the Odoo community can also provide valuable insights and support for customisation.

3. Pricing for Larger Enterprises

Challenge: For larger enterprises with complex financial needs, the cost of the Enterprise Plan, while justified by its features, could be relatively high.

Suggestions: For organisations concerned about pricing, it's essential to evaluate ROI that Odoo Accounting offers.

The extensive features and support provided by the Enterprise Plan can often result in cost savings and operational efficiencies that justify the investment.

4. Limited Third-Party Integrations

Challenge: While Odoo Accounting integrates well with other Odoo modules, the range of third-party integrations can be more limited compared to some other accounting software.

Suggestions: Assess your integration needs carefully. If you require specific third-party integrations, research whether Odoo's ecosystem provides those integrations or if custom development is an option.

Odoo continually expands its integrations, so it's super valuable to stay updated on their integration offerings.

5. Mobile App Limitations

Challenge: Odoo's mobile app may have certain limitations compared to the desktop version.

Suggestions: For users who rely on mobile access, it's important to thoroughly test the mobile app to ensure it meets your requirements. Always consider using the mobile app primarily for quick updates and approvals, while more detailed work can then be done on the desktop version.

6. Updates and Maintenance

Challenge: Keeping the software up to date and managing regular maintenance can be a task that requires attention.

Suggestions: Odoo typically releases updates to improve software performance and security. It's important to regularly update the software to benefit from these enhancements and security patches. If you lack in-house IT expertise, consider engaging with an Odoo partner or expert to handle updates and maintenance.

7. Initial Implementation Effort

Challenge: The initial implementation of Odoo Accounting, can be particularly for complex businesses, can require significant effort.

Suggestions: Plan your implementation super carefully, involving key stakeholders from different departments. Seek guidance from Odoo's consultants or partners during the setup and configuration process to ensure a smooth transition.

While Odoo Accounting is a big powerful accounting software with numerous advantages, it's always important to be aware of potential challenges.

By proactively addressing these limitations and leveraging available resources, users can maximise the benefits of Odoo Accounting and navigate any challenges effectively.

Whilst Odoo offers numerous advantages, it's important to be aware of certain challenges. These include the learning curve for advanced features & customisation complexity. It is advised to consult with an Odoo Partner.

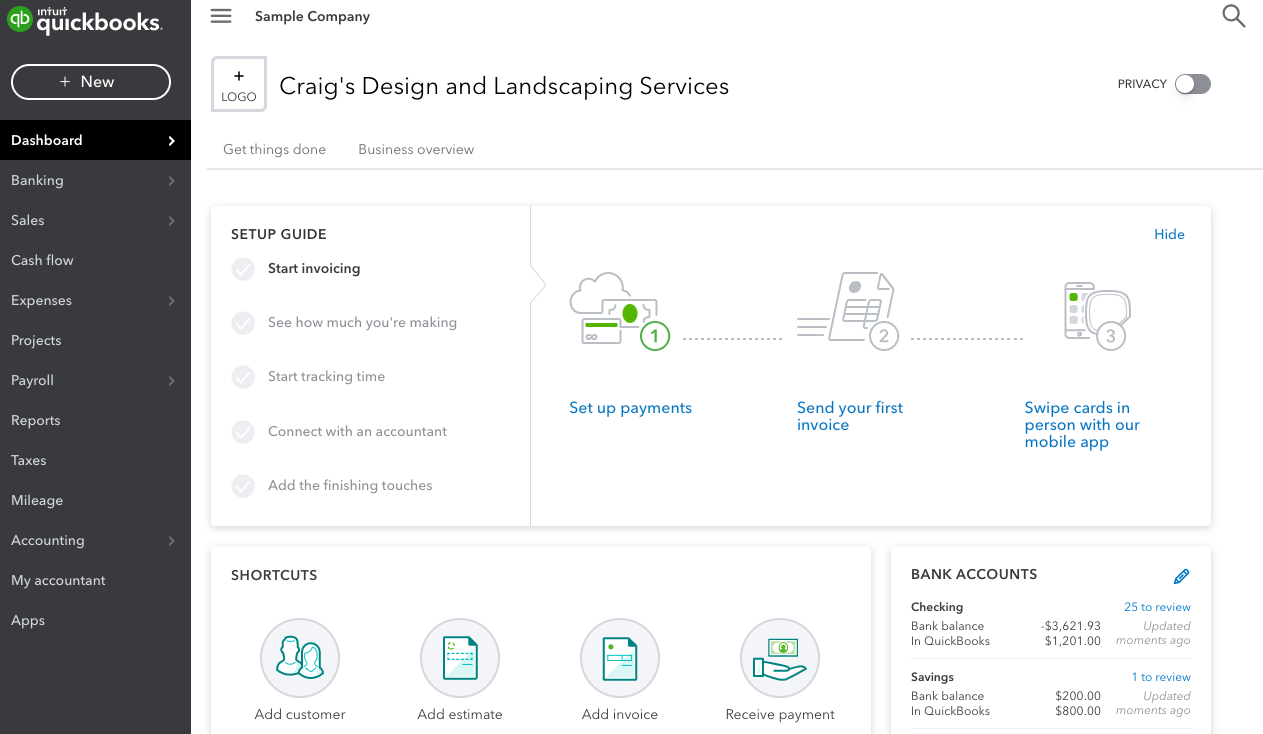

Competing Accounting Software

While Odoo Accounting offers a range of advantages, it's valuable to consider how it compares to other accounting software options in the market.

[Source - Float Cashflow Forecasting]

Here are a few competing accounting software solutions, along with a brief comparison highlighting Odoo Accounting's strengths:

1. Odoo Vs QuickBooks

Strengths of QuickBooks:

- QuickBooks is a popular choice known for its user-friendly interface and accessibility.

- It offers a wide range of plans suitable for various business sizes.

- QuickBooks has a large user base and an extensive network of certified accountants and bookkeepers for support.

Strengths of Odoo Accounting (Compared):

- Odoo Accounting's comprehensive feature set, including advanced reporting and multi-company support, provides a broader spectrum of functionality.

- Odoo's extensive customisation options allow businesses to tailor the software to their unique processes.

- While QuickBooks may be more accessible to smaller businesses, Odoo Accounting's scalability makes it suitable for businesses at various stages of growth.

2. Odoo Vs Xero

Strengths of Xero:

- Xero is known for its ease of use and offers a straightforward interface.

- It provides strong support for bank reconciliations and a wide array of third-party integrations.

- Xero offers competitive pricing and often targets small to medium-sized businesses.

Strengths of Odoo Accounting (Compared):

- Odoo Accounting's automation features, advanced expense management, and multi-company support offer a broader range of capabilities.

- Odoo's extensive customisation options enable businesses to align the software with their unique processes, potentially resulting in higher flexibility.

- Xero may excel in simplicity, but Odoo's feature set is more comprehensive and scalable for businesses with growing accounting needs.

BOOK A FREE ODOO ACCOUNTING DEMO

Book a free demo and discover how Odoo Accounting can revolutionise your financial management.

3. Odoo Vs FreshBooks

Strengths of FreshBooks:

- FreshBooks is renowned for its user-friendly design and excellent invoice management.

- It offers robust time tracking and project management features, making it suitable for service-based businesses.

- FreshBooks has straightforward pricing and is often chosen by freelancers and small businesses.

Strengths of Odoo Accounting (Compared):

- Odoo Accounting's feature set extends beyond simple invoice management, offering advanced automation, customisation, and in-depth financial reporting.

- Odoo Accounting's multi-company support and extensive customisation options are beneficial for larger organisations and businesses with diverse needs.

- While FreshBooks serves its niche well, Odoo Accounting's versatility and scalability make it more suitable for a wide range of business sizes and types.

4. Odoo Vs Zoho Books

Strengths of Zoho Books:

- Zoho Books is part of the Zoho suite, allowing for seamless integration with other Zoho applications.

- It offers good automation features and is known for strong inventory management capabilities.

- Zoho Books provides competitive pricing and is often chosen by small and medium-sized businesses.

Strengths of Odoo Accounting (Compared):

- Odoo Accounting's extensive customisation options, scalability, and comprehensive feature set offer more versatility for businesses with varied needs.

- Odoo's multi-company support and advanced reporting tools cater to larger organisations and those requiring complex financial management.

- While Zoho Books excels in integration with the Zoho suite, Odoo Accounting offers a broader range of financial features and customisation.

Odoo Accounting stands out as a robust accounting software solution that offers a full comprehensive feature set, extensive customisation options, and scalability, making it suitable for businesses of various sizes and needs.

While other accounting software options have their strengths, Odoo's versatility and capabilities position it as a powerful choice for efficient financial management across different industries and business scales.

Informed Choices: Odoo Accounting as Your Financial Partner

In this comprehensive review, we've delved into the world of Odoo Accounting, exploring its features, benefits, and its position in the accounting software landscape.

[Source - hibou.io]

As we conclude, let's recap the key points discussed and emphasise the benefits of Odoo Accounting for businesses of all sizes.

Summary of Key Points

- Setup and User Interface: We discussed the straightforward setup process and the user-friendly interface of Odoo Accounting, making it accessible to users with varying levels of accounting expertise.

- Core Accounting Features: Odoo Accounting offers a wide array of core accounting features, including general ledger management, accounts payable/receivable, and bank reconciliation, streamlining financial operations.

- Automation and Efficiency: Automation features, such as invoice generation and expense tracking, enhance efficiency and reduce manual workloads.

- Reporting and Analytics: Odoo Accounting's reporting tools and analytics provide businesses with valuable insights to make informed financial decisions.

- Pricing Plans: We outlined Odoo Accounting's pricing plans, catering to businesses with diverse budgets and needs.

- Free Trial and Tutorials: We highlighted the importance of trying Odoo Accounting through a free trial and tutorials to assess its suitability for your specific requirements.

- Case Studies: We presented fictional case studies showcasing how businesses have benefited from Odoo Accounting.

- Pros: We discussed the advantages of using Odoo Accounting, including its comprehensive features, user-friendliness, scalability, customisation options, and more.

- Cons: We acknowledged potential limitations and provided suggestions for overcoming challenges associated with Odoo Accounting.

- Competing Accounting Software: We briefly compared Odoo Accounting with other accounting software options in the market, emphasising its strengths.

Reiterating the Benefits

Odoo Accounting emerges as a powerful and versatile accounting software solution. Its key benefits include:

- Comprehensive Features: Odoo Accounting offers a wide range of financial tools, automation capabilities, and in-depth reporting, making it suitable for businesses with varied accounting needs.

- User-Friendly: Its intuitive interface ensures ease of use, reducing the learning curve for users.

- Scalability: Odoo Accounting grows with your business, making it suitable for start-ups, small businesses, and larger enterprises.

- Customisation: Extensive customisation options allow businesses to tailor the software to their unique processes.

- Versatility: Odoo Accounting offers multi-company support, catering to organisations with complex structures.

- Pricing Flexibility: With various pricing plans, including a free plan, it caters to businesses with different budgets.

Make An Informed Decision

As you consider your accounting software needs, we encourage you to evaluate your specific requirements, budget constraints, and the stage of growth your business is in.

Odoo Accounting offers a compelling solution for a broad range of scenarios. By exploring the free trial and demo, you can experience the software first-hand and determine if it truely aligns with your unique accounting needs.

Additional Resources

To further assist you in your journey with Odoo Accounting, here are additional resources:

- Official Odoo Accounting Website: Access detailed information, pricing, and resources directly from Odoo.

- Tutorials and Documentation: Explore comprehensive tutorials and documentation to help you make the most of Odoo Accounting.

- Frequently Asked Questions (FAQs): Answers to common questions and concerns from the Odoo support team.

- Customer Support: Reach out to Odoo's customer support for assistance and guidance on any issues or inquiries.

We encourage you to explore these resources, take advantage of the free trial and demo, and also reach out to Odoo's customer support as needed. Making an informed choice about your accounting software is crucial for the financial health of your business.

LEARN MORE ABOUT ACCOUNTING

Trust us to provide top-notch support, allowing you to focus on what you do best – driving your business forward.

Odoo Accounting FAQs

Odoo Accounting is a robust accounting software solution designed to streamline all the financial operations for businesses of all sizes. Its benefits include key automation, real-time reporting, and scalability, enabling more efficient financial management.

Odoo Accounting distinguishes itself with its comprehensive feature set, user-friendly interface, customisation options, and its scalability. Compared to other accounting software, it offers more versatility for businesses with varying accounting needs and growth stages.

Odoo Accounting caters to a wide range of industries and business sizes. Whether you're a start-up, small business, or a large enterprise, Odoo Accounting's flexible features and pricing plans can be tailored to meet your unique needs.

Odoo Accounting offers a multitude of features, including general ledger, accounts payable and receivable, bank reconciliation, and expense tracking. Additionally, Odoo Accounting provides advanced reporting and analytics tools to facilitate data visualization, drill-down analysis, and budget vs. actual comparisons.

Getting started with Odoo Accounting is easy. Visit the official Odoo Accounting website, explore the available resources, and choose a pricing plan that aligns with your budget. If you ever need a helping hand, guidance, or want to discuss how Odoo can revolutionise your financial management, don't hesitate to contact us.

Odoo offers multiple pricing plans to accommodate diverse budgets. The free plan makes it accessible for start-ups and small businesses. Paid plans with advanced features are also available for those with more extensive financial management requirements.

Odoo provides a range of resources to assist users in utilising Odoo Accounting. Comprehensive tutorials & documentation are available to help users make the most of the software. Should you need any further help or support you can contact us.

Yes, Odoo Accounting is highly customisable. Businesses can tailor the software to match their specific accounting workflows, ensuring alignment with their financial processes and regulatory compliance. This customisability enhances the software's versatility and its ability to meet unique business requirements effectively.

While Odoo Accounting offers numerous advantages, it's essential to be aware of potential challenges. For example, the extensive feature set may create a learning curve, particularly for any users new to accounting software. To overcome this, investing time in training and education for your team is recommended.

Yes, Odoo Accounting offers a free trial. You can experience Odoo's functionality first-hand. You can also book a demo with us and our experts will guide you through its features, answering your questions and helping you understand how it can benefit your business.